Latest inflation data suggest that the Fed will likely remain conservative in its rate cuts, far short of Trump’s preferred 1% level.

Summary

- U.S. services inflation remained high in August, removing hopes for a higher rate cut

- The Fed will still likely cut interest rates by 25 basis points, as expected

- Higher-than expected interest rates chances hurt Bitcoin

Latest inflation data hurt the chances that the Fed might cut rates more than expected. On Thursday, September 4, Bitcoin (BTC) was down 2.4%, trading at $109,444, following reports that services inflation remains high. What is more, altcoins lost even more, with the top 20 tokens down 2.7%.

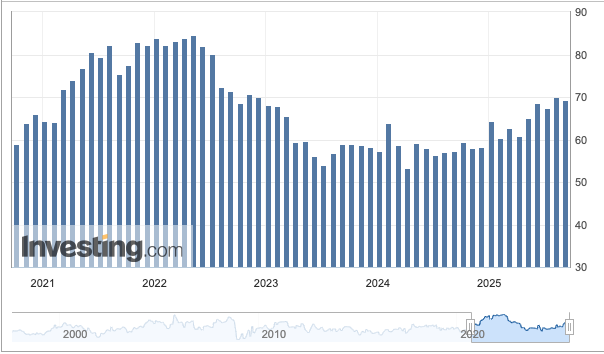

Crypto markets reacted to the ISM Services Prices Index, which was at 69.2 in August. Services inflation was below the expected 69.5 level as well as the 69.9 level the previous month. Still, the figure remains at levels last seen in 2023, and any reading above 50 means that prices are rising.

Elevated inflation figures will likely make the Federal Reserve more cautious when deciding on interest rates in the upcoming September 17 meeting. Still, a rate cut of 25 basis points remains the most likely outcome, on which Polymarket traders put an 86% probability.

Trump’s massive rate cuts less likely

New inflation data will likely undercut Donald Trump’s push for a major rate cut. The president has been pushing for lower interest rates almost since he was elected. However, since July, Trump has set a new target of 1%, a massive change from the current 4.25% to 4.50% range.

Still, Trump has more avenues to bypass the Fed. For one, the Treasury Department, under Trump’s direct control, continues to buy its own Treasuries, most recently $2 billion on September 3. This operation, which Investing.com analyst called “QE without the Fed,” aims to reduce the borrowing cost for the government.