Bitcoin is pressing up against one of its most consequential resistance zones of the cycle, and popular crypto analyst Trader Mayne says the next few days will determine whether bulls reclaim momentum—or watch the rally stall into a lower high.

Summary

- Bitcoin’s ability to clear the heavy confluence zone at $98K–$100K will dictate whether the market stages a final leg higher into year-end or slips back into a broader downtrend.

- “This remains the critical area for me,” Trader Mayne says.

- A clean break of the $98K–$100K band could flip those odds—and potentially ignite the last major rally of the cycle.

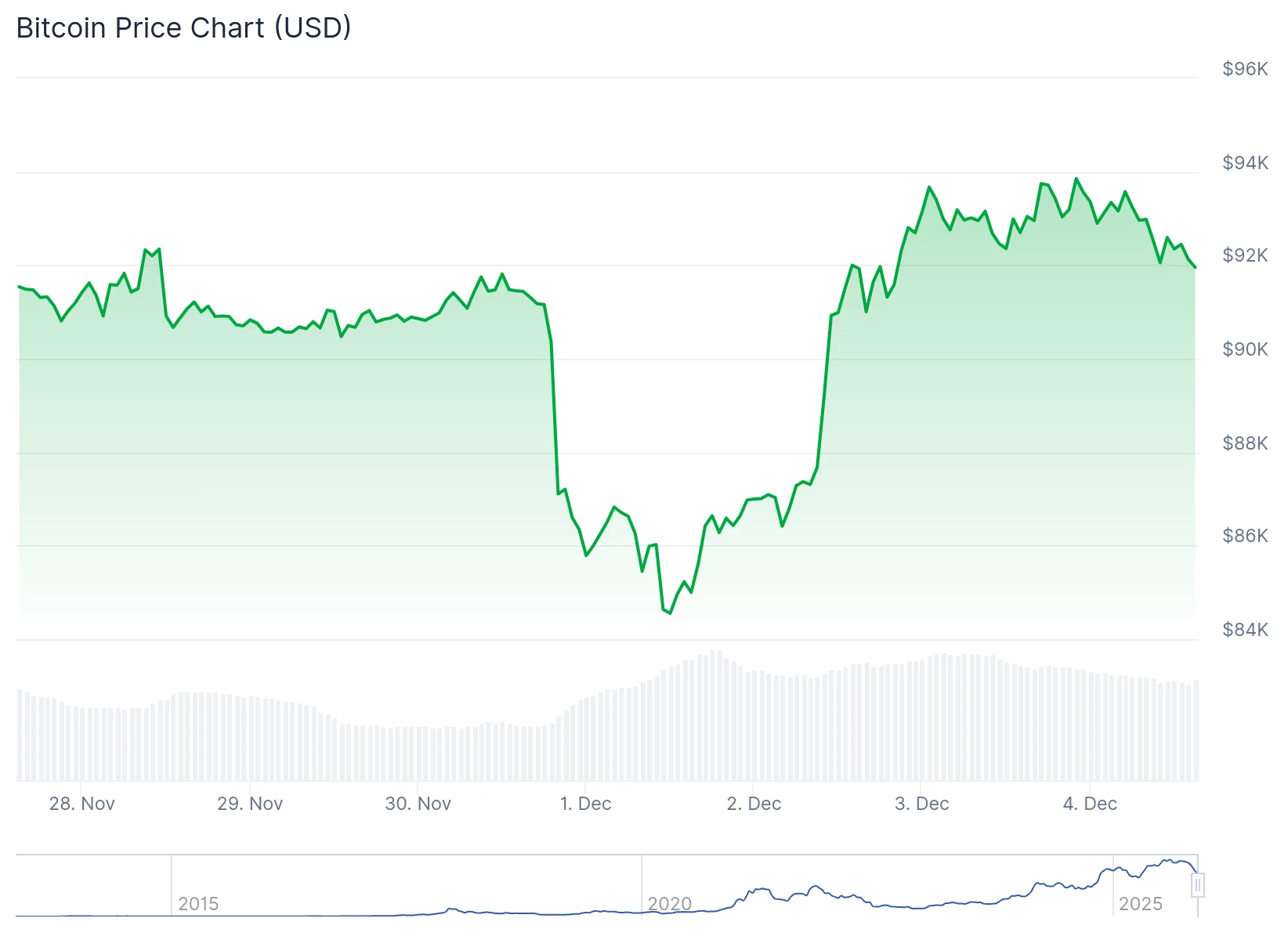

Bitcoin has climbed back to its yearly open level after what Trader Mayne described as “a nice couple of trade opportunities” following the formation of an $80,000 cycle low. The move has broken an “aggressive downtrend,” but the analyst emphasized that the real test still lies ahead: a daily downtrend line intersecting with the former price floor around $98,000.

The zone aligns with the series of lower highs defining Bitcoin’s macro downtrend. Clearing it would mark the first meaningful shift in high-time-frame structure since the all-time high near $125,000.

For now, Bitcoin has staged what Mayne called “relatively constructive” price action—higher lows are forming, and a four-hour bullish structure break is underway. But the market has yet to print a higher high on the H4 chart. “I need follow-through,” he said. “I need a higher high here.”

A Lower High Before the Next Bear Market?

Mayne reiterated that he still assigns a 70%–80% probability to Bitcoin forming a lower high rather than a new all-time high. But that probability “drops to 50–60%” if bulls reclaim $98K and break the downtrend. The level, he said, would also confirm the weekly cycle low—setting up what he believes would be the final rally of the four-year cycle before a bear market in 2026.

Cycle catalysts, he added, include the end of Federal Reserve quantitative tightening, renewed liquidity expectations, and sentiment shifts such as Vanguard enabling IBIT buying.

For bulls, the ideal scenario is a clean breakout: “I want to see price just go. I don’t want people to have time to get in.” Choppy consolidation around the yearly open would instead resemble a “bear flag,” increasing the odds the lower high is already in.

Mayne outlined two critical trendline guides: a break above the downtrend line signals bullish continuation, while a break of the rising short-term trendline would indicate the structure is “cooked.”

Despite the near-term optimism, Mayne stressed caution. His personal strategy is to sell spot positions into strength—ideally near $100K or higher—before a larger cyclical pullback that could revisit $50K–$60K.

“Any sign of weakness at the yearly open, 98K, 100K, 105–110K—derisk, hedge, ready to get the **out,” he said.

Should Bitcoin fail to break higher, he expects opportunities on the short side: “A bear market is just the inverse of a bull market…just invert the chart.”

Dollar Dynamics Align—for Now

Mayne said macro signals are supportive, noting USD dominance is pulling back and the U.S. dollar index is rejecting a key resistance. “We want to see this make one more low. That’s the best case for stocks, for crypto, for everything.”

Bitcoin is perched on its most important resistance since topping out. A decisive push through $98K–$100K could shift market structure, sentiment, and cycle dynamics all at once. Failure there may confirm the top is already in.

As Mayne put it: “The bulls still have work to do. The bears are still in control.”