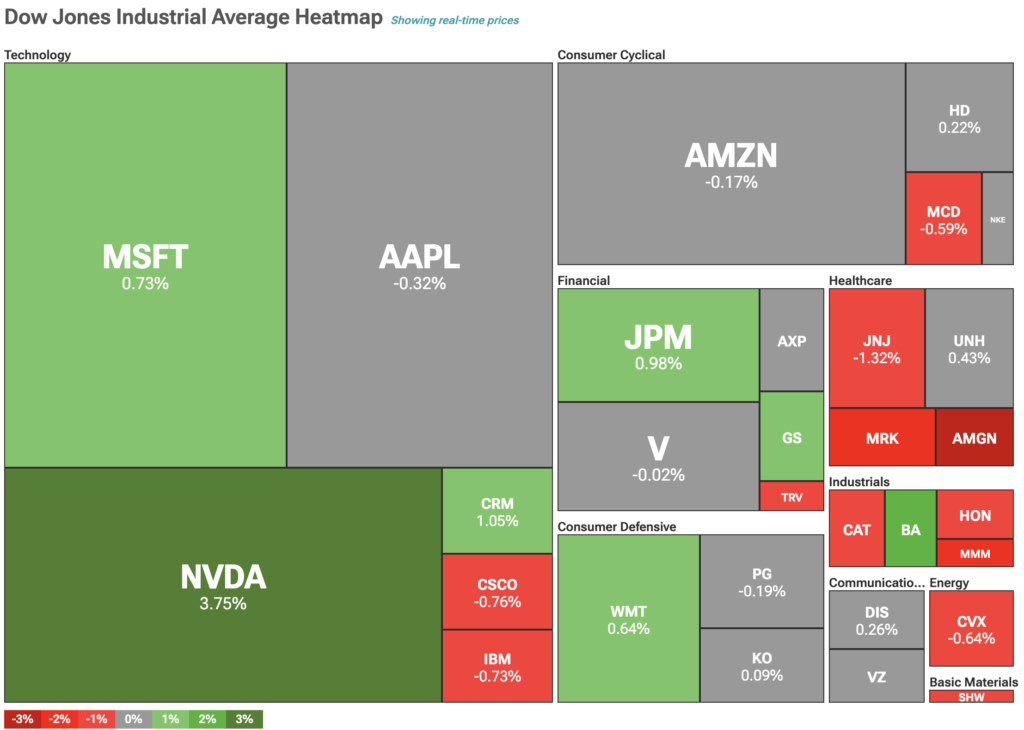

U.S. stocks were slightly mixed on Wednesday, as chipmakers saw major gains on new deals with Saudi Arabia.

Stocks were mixed on Wednesday, with the Dow Jones trading lower by around 0.25% while the S&P 500 remained flat. The tech-heavy Nasdaq rose 0.75%, or 142.58 points, to 19,150.

This performance followed a strong showing earlier in the week, as investors reacted to the pausing of reciprocal tariffs between the U.S. and China. Adding to the positive sentiment, recently released April inflation figures were at their lowest levels since 2021.

Chipmakers lead Nasdaq rally

Easing trade relations and lower inflation data contributed to bullish sentiment in the markets. Among the best performers were tech stocks, especially chipmakers, which benefited from a recently negotiated deal between U.S. firms and Saudi Arabia.

Specifically, during an investment forum on Tuesday attended by U.S. President Donald Trump, Saudi Arabia announced billions in deals with chipmakers. Following the news, the world’s largest chipmaker, Nvidia, rose 3.75%, trading at $134.85 per share.

Despite the positive sentiment in equities, the dollar index edged lower on Wednesday, down 0.21% to 100.80 points. At the same time, gold posted significant losses of 1.91%, trading at $3,182.22. A divestment from the dollar and gold indicates that investors are chasing bigger returns in the stock markets.

Bitcoin (BTC) once again moved in the same direction as gold, down 0.66% to $103,378. Still, the digital gold thesis for Bitcoin is not the only explanation, as crypto prices began rallying days ahead of the stock markets when Bitcoin first broke $100,000. Instead, crypto prices are likely consolidating and cooling off—suggesting that the same may follow for stocks in the near future.