Short interest in Ethereum has skyrocketed by 500% since Nov. 2024, raising questions about whether a looming short squeeze could close the widening performance gap with Bitcoin, despite regulatory support.

In the past week, short interest in Ethereum has surged by an eye-watering 40%, bringing the total increase to a staggering 500% since November 2024, according to The Kobeissi Letter, an industry leading commentary on the global capital markets.

For years, Ethereum has been under scrutiny, particularly around the fear that it could be classified as a security by the SEC. However, with the new regulatory environment under the Trump administration, experts believe that this is now unlikely. In fact, Eric Trump recently posted on X that “it’s a great time to add ETH,” causing a brief surge in Ethereum’s price. Despite this shift in regulatory tone, Ethereum (ETH) is now facing the highest short positioning it has ever seen.

The analysts at The Kobeissi Letter point to a particularly volatile period around Feb. 2, when Ethereum dropped by 37% in just 60 hours on the trade war headlines. They also highlight strong inflows into ETH during Dec. 2024, despite reports that hedge funds were increasing their short positions. In just three weeks, ETH saw over $2 billion in new funds, including a record-breaking weekly inflow of $854 million.

Additionally, they noted significant spikes in Ethereum trading volume, particularly on Jan. 21 (Inauguration Day) and during the Feb. 3 crash. Despite the high inflows, Ethereum’s price has struggled to recover, remaining about 45% below its ATH set in Nov. 2021, even after a week has passed.

What do hedge funds know is coming?

With all of this taken into consideration, The Kobeissi Letter analysts wonder, “What do hedge funds know is coming?” They speculate on possible explanations, ranging from market manipulation and routine crypto hedging strategies to a simple-and-plain bearish outlook on Ethereum’s future. “However, this is rather strange as the Trump Administration and new regulators have favored ETH,” they wrote in the X post.

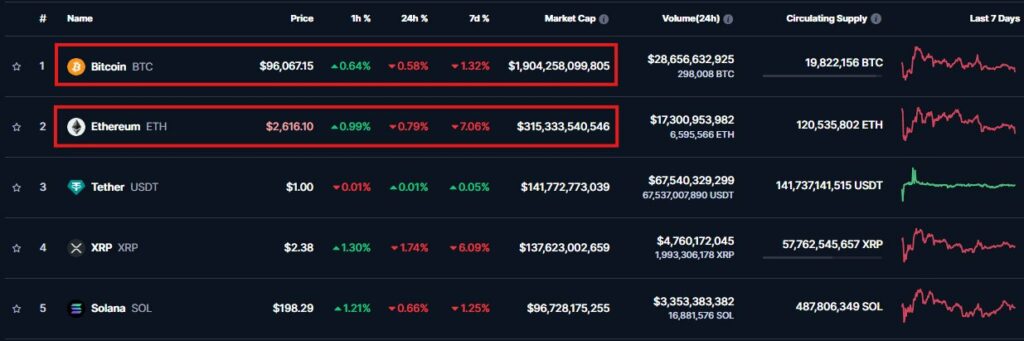

To wrap it up, The Kobeissi Letter analysts suggest that the extreme positioning in Ethereum’s market is likely to lead to more significant price swings, similar to the one seen on Feb. 3. Furthermore, they question whether a short squeeze could help close the performance gap between Bitcoin and Ethereum. To put it into perspective, since the beginning of 2024, Bitcoin has outperformed Ethereum by about 12 times. Moreover, Ethereum’s market cap has shrunk in comparison to Bitcoin, which is now six times larger than ETH. This is the largest disparity between the two assets since 2020.